For innovative solutions to their data challenges, Davivienda has turned to Dataiku, using the platform to transform their processes and drive success for more than one initiative with lasting impact. The implementation of these use cases has showcased significant value, not only in financial terms but across various facets of Davivienda’s operations.

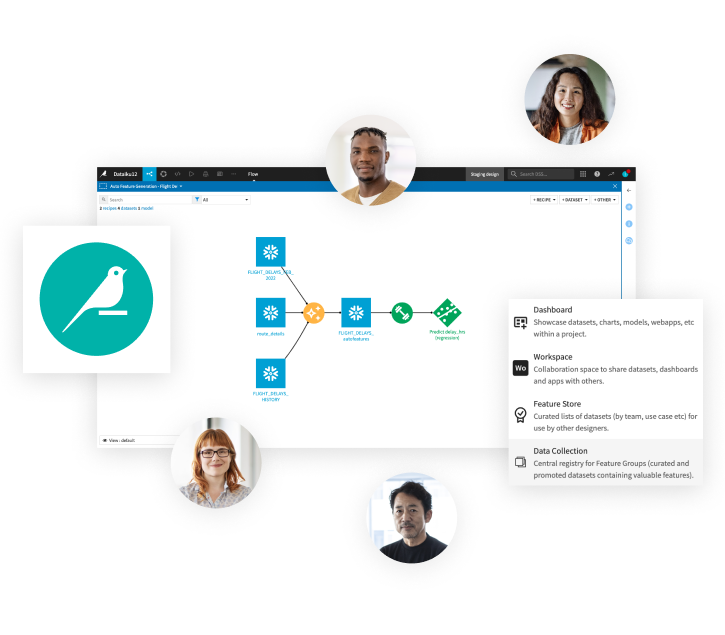

Dataiku Key Capabilities allow teams to work better and faster, integrating seamlessly with existing infrastructure, driving efficiency, and reducing redundancy. Additionally, Dataiku’s role in risk management and transparency has enhanced the organization’s ability to maintain governance and control while also empowering its employees with more access to data and insights.

The continued collaboration between Dataiku and Davivienda heralds a promising future of leveraging technology with agility and foresight.

Here are a few of the use cases that are in action at the bank today, for a quick glimpse into their data and AI evolution:

Addressing Lack of Financial Inclusion With Recommender Systems

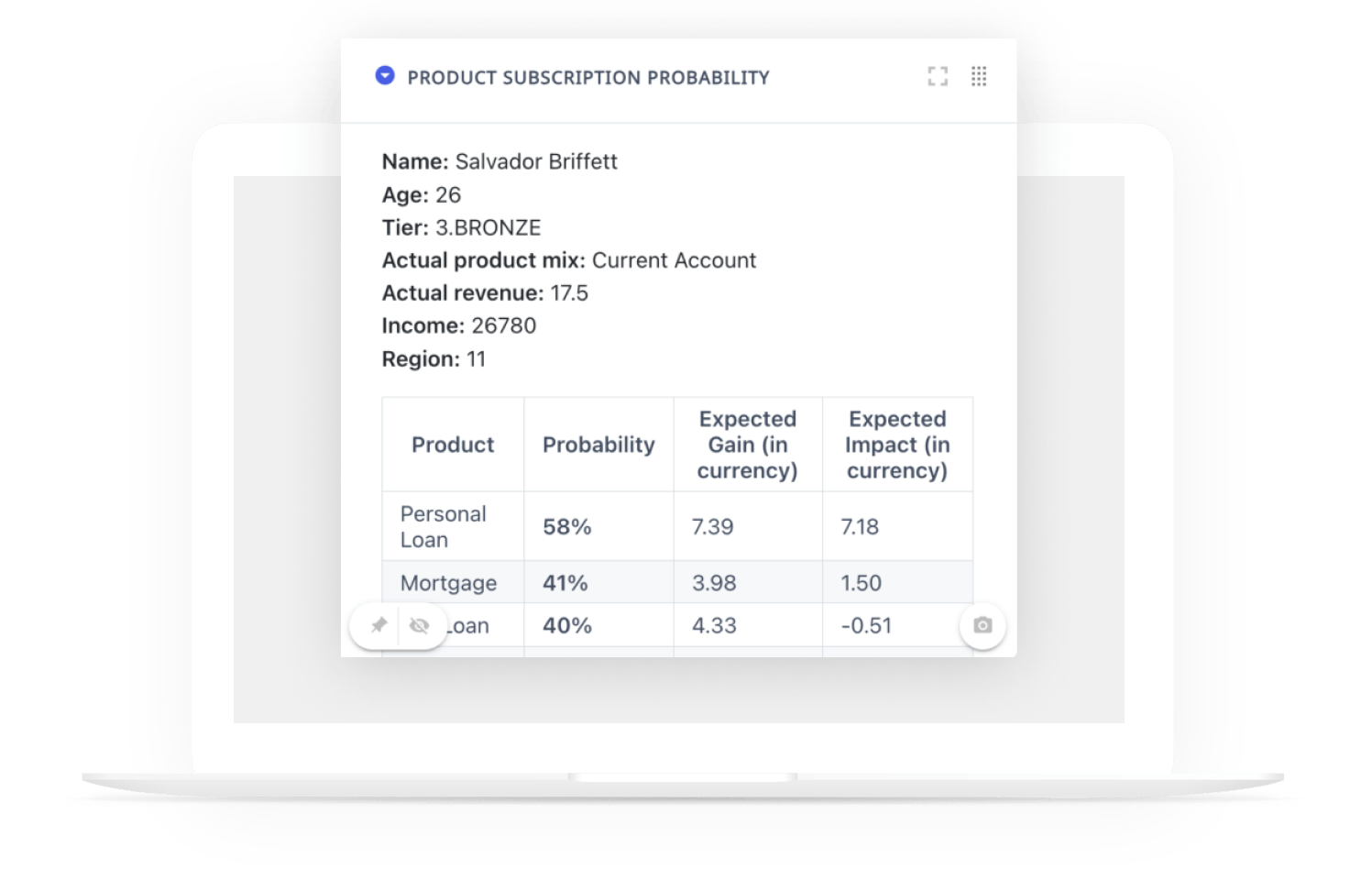

DaviPlata, a project launched by Davivienda in 2011, aims to fully democratize financial services for the low-income population in Colombia. However, a lack of traceability for DaviPlata users hindered the ability to personalize product offers. Davivienda noticed this barrier and sought out an appropriate solution that would work with the existing groundwork of the project.

By allowing the data team to amalgamate historic and new data from various disparate sources, Dataiku enabled Davivienda to implement a field-aware factorization machine recommender system, offering financial products to 12.1 million customers. That’s 4.23 million more than before the solution was implemented! This recommender system has allowed Davivienda to offer financial services to the low-income segment in a remarkable, breakthrough way.

Streamlining Operations With the Comprehensive Customer Score

At Davivienda, many areas in the bank had their own customer segmentation and prioritization systems, and these systems often were inconsistent in addition to being based on subjectively selected variables (rather than statistical analysis and AI techniques). For example, credit risk management might select its best clients based on credit score, while the credit placement department selects discounts on interest rates based on the amounts the client has within the bank.

Recognizing the need for a unified prioritization system, Davivienda started a project to develop what they call a Comprehensive Customer Score to address inconsistent customer prioritization across departments.

The team, which included data scientists, business analysts, and CDO personnel, now harnesses Dataiku to connect with Cloudera and develop a personalized optimization technique. The end-to-end process, seamlessly executed within Dataiku, transformed the team’s day-to-day operations, enhancing data-driven decision-making and resource allocation. The Comprehensive Customer Score project generated an impressive return on investment of approximately $2.6 million, all achieved with minimal costs.

Constructing a Solution to Derive Credit Risk Scores for Personal Banking Customers

Bank credit products at Davivienda originate in one of two ways: by customer request, or via credit campaigns. For the former, the follow-up action is that the bank must decide whether to approve, modify, or deny the requested credit. For the latter, the bank conducts internal studies, seeking clients with good financial behavior to offer credit products that are part of the bank’s portfolio.

However, the traditional reliance on hard risk policies for customer selection was restrictive, limiting the outreach to potential clients. These ad hoc approaches not only led to inconsistent results between different areas of the bank, they also did not capture the complete gamma of information available to evaluate customers. This created friction between processes and a bottleneck to the customer funnel.

To overcome this barrier, Davivienda used Dataiku to create a predictive model trained to generate a credit risk score for personal banking customers, reshaping the decision-making framework by replacing expert-driven filters with a sophisticated data science approach. Dataiku offered several key advantages for this use case:

- The model runs on over 15 million records with more than 30 features, so executing it locally was complex — Dataiku could handle the volume, and with a more friendly user interface.

- Credit risk managers frequently request exercises and tests. Dataiku’s flexible pipelines meant the team could turn around results to those requests in less than a day.

- Dataiku allows the team to perform most of the steps of the CRISP-DM methodology in a single interface.

This transformative partnership resulted in a remarkable change in customer evaluation and, in turn, a monthly surge of 1.4 million individuals in the customer credit campaign funnel, catapulting from 2.3 million to an impressive 3.7 million. The impact extended to credit disbursement behavior, driving a substantial reduction in default probability from 4.9% to an enviable 3.8% — a 22% decrease in credit card payment defaults.

Crafting an Improved Financial Health Indicator (FHI) for Enhanced Customer Insight & Collection Strategy Optimization

When it comes to approving credits, Davivienda is always trying to find the balance that will minimize the risk of default. However, customers will inevitably default for a variety of factors — it is, therefore, crucial to find an efficient way to focus the efforts of the collections department, including defining more aggressive strategies for customers who pose a greater challenge in terms of payment. The ultimate objective is to find the right balance between maximizing recovery and reducing operational costs along with maintaining a good relationship and appropriate service levels with customers.

To meet this goal, Davivienda developed a financial health ecosystem that allows for a global understanding of the life stage of users and improves collection strategies. As part of this ecosystem, they used Dataiku to develop a probability of payment score, constructed using segmentations and machine learning techniques that take into account the customer’s historical information, obligations, and behavior in the financial sector. The team ultimately created not just one but 18 models, each tailored to a specific customer segment.

This probability of payment score, along with institutional policies and considerations, enables the definition of a more robust collections strategy tailored to each customer.

Dataiku provided an intuitive interface that allowed us to access and manipulate large volumes of customer information, totaling approximately 20 million records. Dataiku provided us with a significant advantage by streamlining and simplifying data analysis, manipulation, and modeling tasks, resulting in a more sophisticated and effective solution to address the challenge of portfolio management and collections in our credit institution.

A Testament to the Power of AI in Financial Services

The success stories presented — including a $2.6 million revenue boost, a 1.1% decrease in credit card payment defaults, and the addition of 1.4 million individuals to the credit campaign funnel monthly — underscore the tangible benefits that Davivienda derives from leveraging Dataiku’s capabilities. Beyond financial metrics, Dataiku plays a pivotal role in fostering operational excellence, risk management, and strategic decision-making for Davivienda. Harnessing AI with precision produced eye-opening results that should turn heads for other financial institutions.