Enhance Credit Card Fraud Detection With Machine Learning

With the Dataiku Solution for Credit Card Fraud, use a variety of fraud detection techniques in an agile, fully governed environment. The result: Reduced false positives for fraudulent transactions and efficient, real-time responses to threats.

Add Machine Learning Alongside Business Rules

Fraud detection rules are complex and well established. However, businesses often base them only on business rules. Adopting a machine learning-based fraud detection approach created an opportunity to enhance both efficiency and focus.

The Dataiku Solution for Credit Card Fraud provides a unified scoring model for a modern, comprehensive strategy. Simply input historical data for transactions and alerts to get started with credit card fraud detection using machine learning. Plus, continue to leverage long-established insights and rules — all in one place, allowing to build trust in new practices.

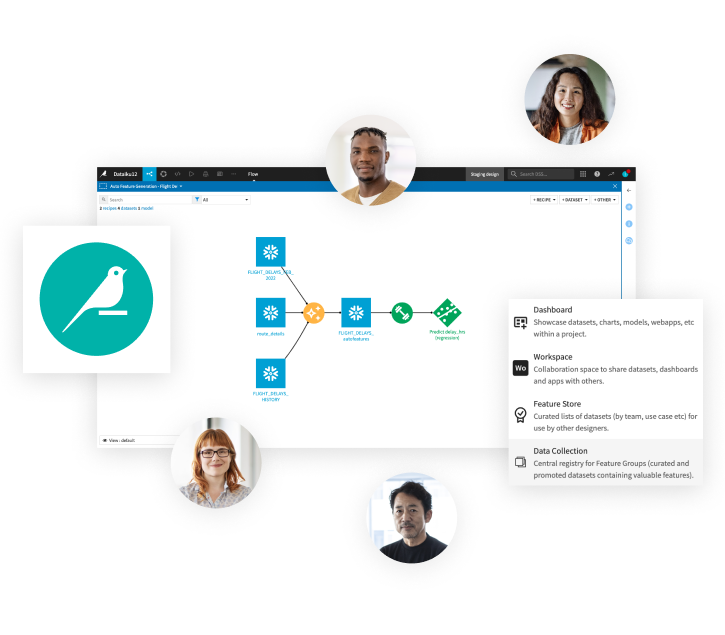

Manage Fraud Processes in One Unified Platform

The Dataiku Solution for Credit Card Fraud isn’t just about modeling. It integrates all aspects of data-driven fraud detection in a single platform. From data wrangling and feature selection down to exploratory analysis, rules creation, alert generation and integration with case management systems.

With all work in a centralized space, teams can ensure they’re working from common data sets and can efficiently track changes. Having a unified platform facilitates comprehensive model and process review as well as advanced retraining and deployment capabilities.

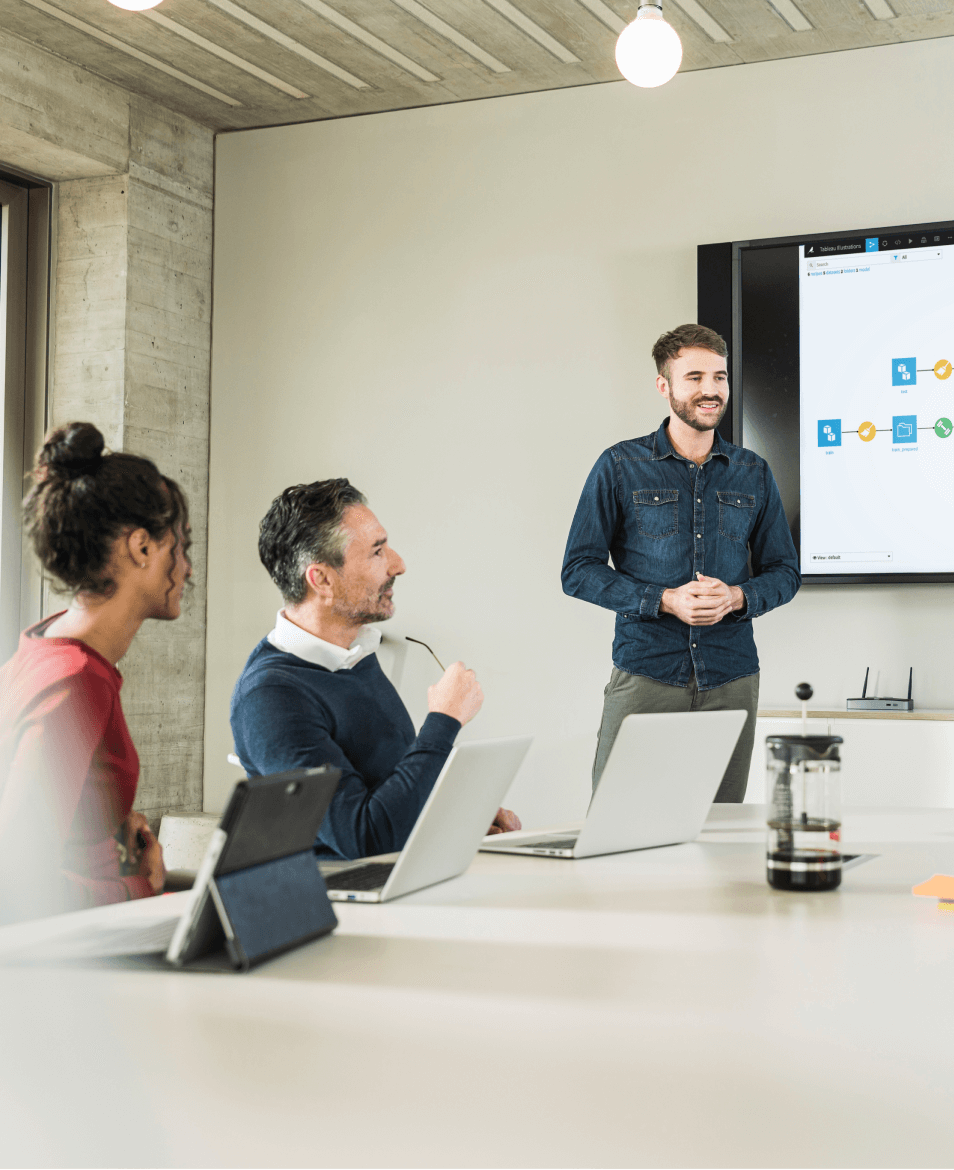

Bring All Stakeholders

to the Table

Dataiku provides one solution for all stakeholders, from administrators to risk managers plus data scientists, fraud analysts, and more. No-, low-, and full-code functionality caters to people across job functions. The Dataiku Solution for Credit Card Fraud brings everyone together to collaborate on the implementation and enhancement of a more efficient and effective fraud detection set-up.

Simplify Data Integration & Exploration

This Dataiku Solution includes pre-built dashboards for powerful data exploration. Fraud analysts can explore visualizations of underlying transactions data as well as key fraud metrics. With these ready-to-explore dashboards, teams can spend more time adjusting alert generation strategies, ensure they fully handle business implications and less time building visualizations.

Streamline Model Approval, Review, & Deployment (MLOps)

Worried about the complexities that come with leveraging machine learning for fraud detection? The Dataiku Solution for Credit Card Fraud has you covered.

Dataiku provides an enterprise-grade model productionization environment with comprehensive model and process review, retrain, and deployment functionality:

- Leverage integrated model re-evaluation and redeployment capabilities to prevent drift and ensure models remain effective over time.

- The solution also comes complete with pre-built drift monitoring dashboards (for prediction, performance, and input data drift).

- Identify potential model enhancements, test them on real-world data to evaluate effectiveness, and elevate approved changes to production — efficiently.

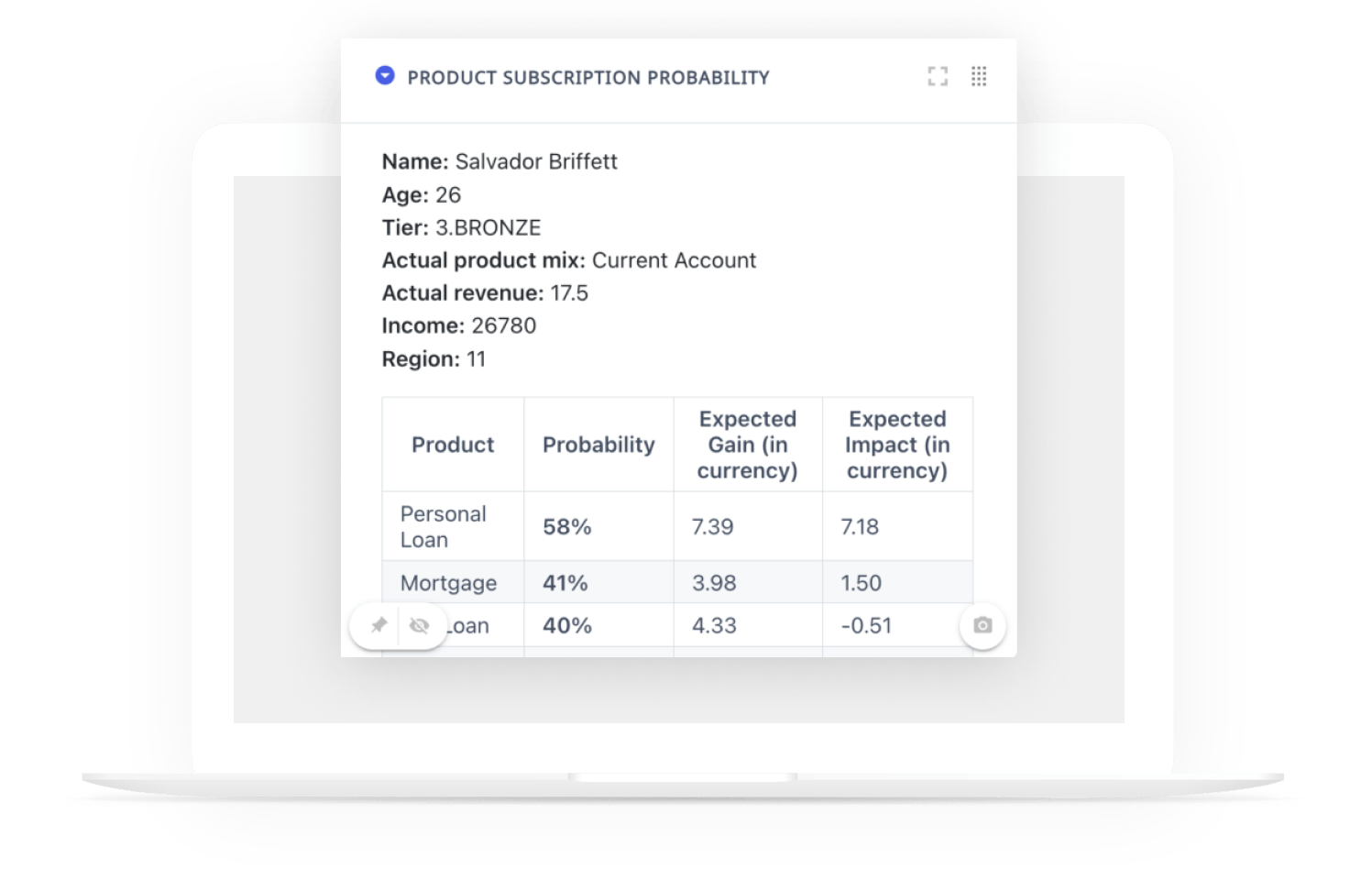

Revolutionize Your Approach to Fraud

Alert Management

This Dataiku Solution also provides all the components for robust alert management. It comes with ready-to-use dashboards for all the metrics required to investigate fraud alerts. Plus, the beauty of the Dataiku Solution is in its versatility. Integration with your choice of operating environments or case management systems is simple and powerful.

Maintain Governance

& Oversight

Why use Dataiku for fraud detection? Beyond this Dataiku Solution, the platform allows you to leverage standardized project and workflow templates. These templates provide clear steps and gates to explore, build, test, deploy, and maintain data projects. That means safely scaling and enhancing fraud systems while also supporting the right level of oversight.

Setup in Days,

Not Weeks or Months

Customers consistently report implementing Dataiku Solutions in an average of two days, with just two hours to deliver first results. Start enhancing existing credit card fraud solutions with machine learning today and answering questions like:

- How can I get the most value from my existing fraud detection rules, while incorporating machine learning?

- How can I quickly validate the impact of changes on real-world data?

- How can I introduce complementary data science approaches without disrupting my existing workflows, and see rapid process improvement?

Make It Your Own

The Dataiku Solution for Credit Card Fraud is an adapt and apply solution. It includes the ability to do:

- Comprehensive fraud detection with ML models and machine learning algorithms, alert management, and MLOps within a single platform.

- Visual exploratory data analysis of transactions, rules, and alerts.

However, organizations can also infinitely expand, extend, and customize it to meet any fraud detection system needs.

Go Beyond

Fraud Detection

By leveraging this Dataiku Solution, you get more that just quick time-to-value on one specific use case. You also get the power of the entire Dataiku platform to go further on additional use cases. Empower people across your business to do more with data and AI. That means building projects faster and working together, all in a shared and safe environment.

The Total Economic Impact™️

Of Dataiku

A composite organization in the commissioned study conducted by Forrester Consulting on behalf of Dataiku saw the following benefits:

reduction in time spent on data analysis, extraction, and preparation.

reduction in time spent on model lifecycle activities (training, deployment, and monitoring).

return on investment

net present value over three years.